Most Important Financial Decision of Your Life For most military retirees, the Survivor Benefit Plan (SBP) is often the most important decision of your financial life. It can also be among the most confusing, emotional, and uncertain. In almost every case, you must make a one-time irrevocable decision that will have lasting impacts for decades. …

How Much Is Your Military Pay Really Worth?

This post about military pay originally appeared as a guest post on The Military Guide so I’m reposting with permission. Ever Wondered Just How Much All Your Military Pay and Benefits Add Up To? For any servicemembers who are transitioning out of the military or perhaps daydreaming about what that might look like someday, many of …

How I Turned $80K in Military Education Benefits Into $2.1 Million in Lifetime Value

Have you ever wondered how beneficial are the education benefits offered by the military? The media, our peers, parents, and even politicians bemoan the ever rising cost of a college education. Recent statistics from StudentLoanHero show that student loan debt in the United States now stands at greater than 1.3 trillion dollars with the average now at $37,172! …

How I Turned $80K in Military Education Benefits Into $2.1 Million in Lifetime ValueRead More

BRS Financial Touchpoints

As part of the MCRMC report back in 2015 that advocated what we now know as the Blended Retirement System (BRS), the commission also recommended creation of more military financial education opportunities. This was to not only help servicemembers understand the new BRS, but also to help combat the troubling challenge of financial illiteracy that often has a negative …

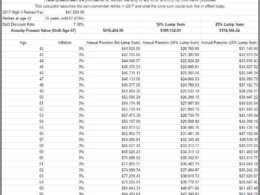

Blended Retirement System Lump Sum Calculator

Blended Retirement System Lump Sum Calculator One of the major new parts of the Blended Retirement System (BRS) is the ability to take either 25% or 50% of the discounted lump sum value of the servicemember’s pension at the time of retirement. I built my own Blended Retirement System Lump Sum Calculator based on my best understanding …

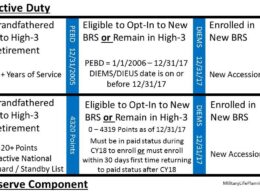

Blended Retirement System Implementation

As the rollout for the Blended Retirement System implementation continues, amplifying details continue to be released for some of the specifics of BRS implementation. On January 27th 2018, DoD released the policy memorandum that will implement BRS guidance including some of the major updates from the 2017 NDAA that modified some of the original plan of the BRS as …

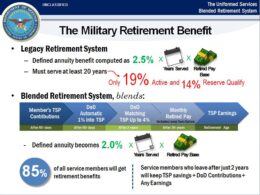

Blended Retirement System Considerations

As the DoD ramps up education efforts on the new Blended Retirement System (BRS), take the time to educate yourself on its specific provisions. Here are some helpful graphics and explanations to help you determine the best choice for your military career. …