As the DoD ramps up education efforts on the new Blended Retirement System (BRS), take the time to educate yourself on its specific provisions. Here are some helpful graphics and explanations to help you determine the best choice for your military career.

Legacy Retirement System

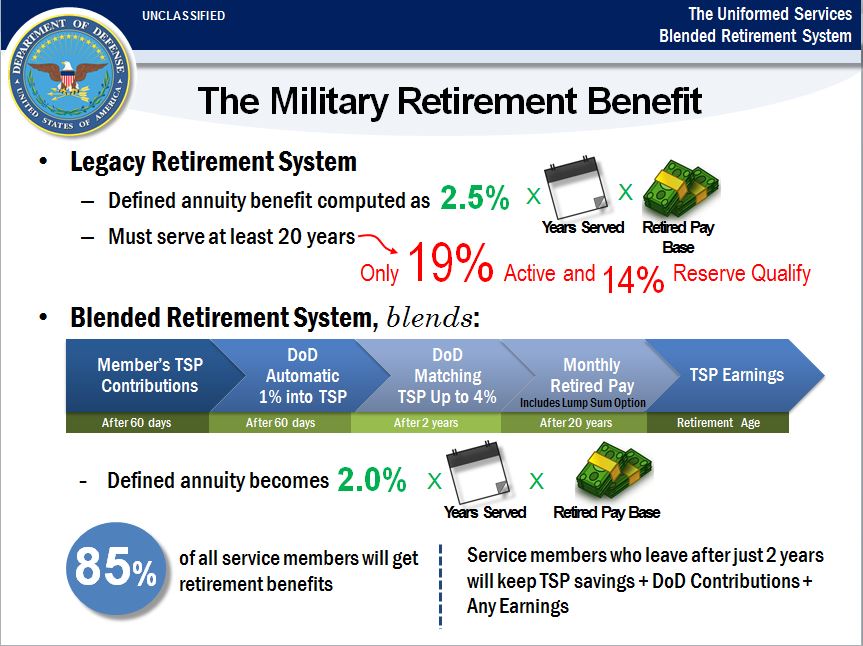

- Under the Legacy Retirement System, which we often call the “High-3 System” because the retired pay is based on an average of a Service member’s highest three years of pay, Service members who complete at least 20 years of active military service are eligible to receive monthly retired pay (aka defined annuity).

- The retired Service member receives monthly retired pay based on years of service and a percentage of a Service member’s pay. How we arrive at that amount of money is represented by the formula you see at the top. Their years of service are multiplied by 2.5% to determine a percentage.

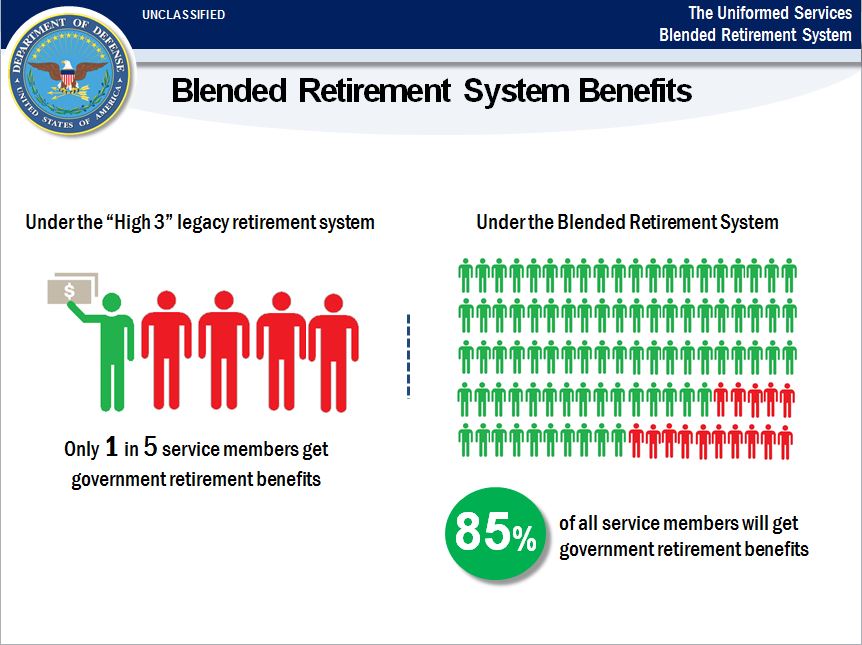

- However, only 19% of active component Service members today qualify for monthly retired pay, and only about 14% of our reserve and National Guard population. This means approximately 81% of active Service members and up to 86% of reservists leave military service with no retirement.

Blended Retirement System:

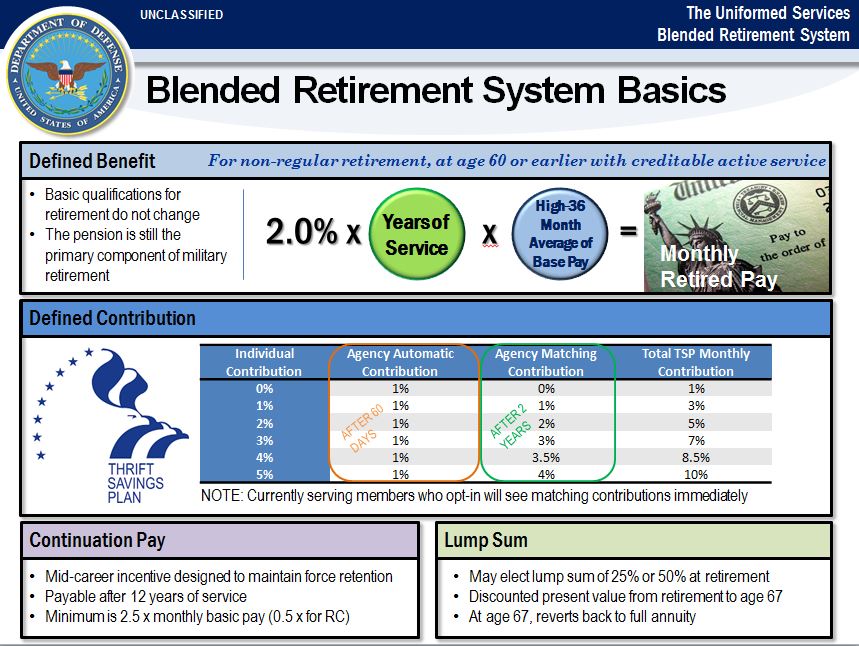

- The new Blended Retirement System combines the legacy 20-year military retirement system (the defined annuity), with a defined contribution plan, known as the Thrift Savings Plan or TSP, as it’s more commonly referred too.

- The defined contribution component or TSP, includes automatic 1% DoD contributions after 60-days and up to 4% additional matching contributions after two-years of service to the member’s TSP account.

- The new Blended Retirement System will now ensure nearly 85 percent of military Service members leave the service with retirement benefits.

- The trade-off as we incorporate matching TSP contributions is that, under the BRS, the annuity is lowered. The formula for calculating retired pay will use a 2.0% multiplier for each year of service rather than 2.5% under the legacy system.

- But the tradeoff is that now the BRS will provide retirement benefits to approximately 85% of the force, rather than the 19% who receive benefits under the legacy system.

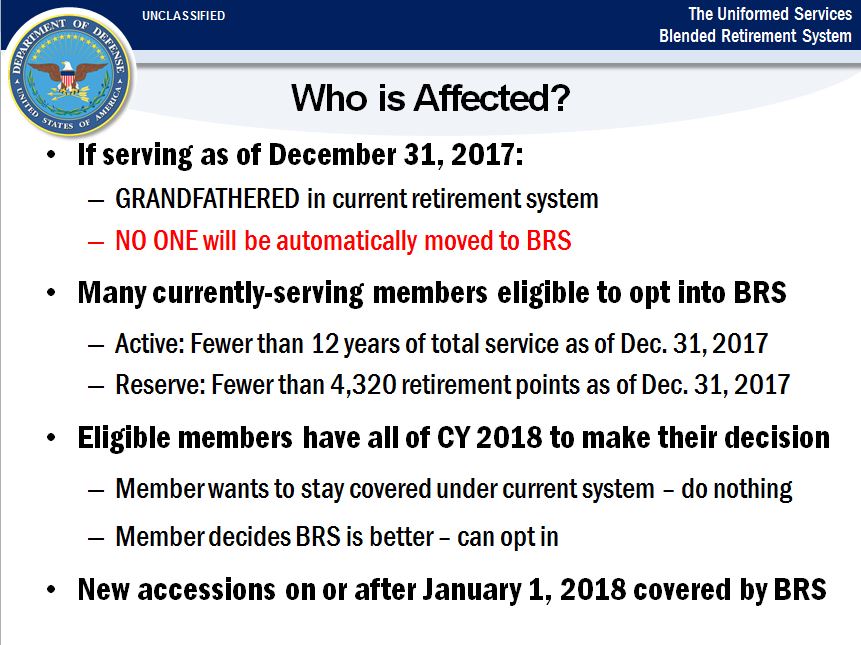

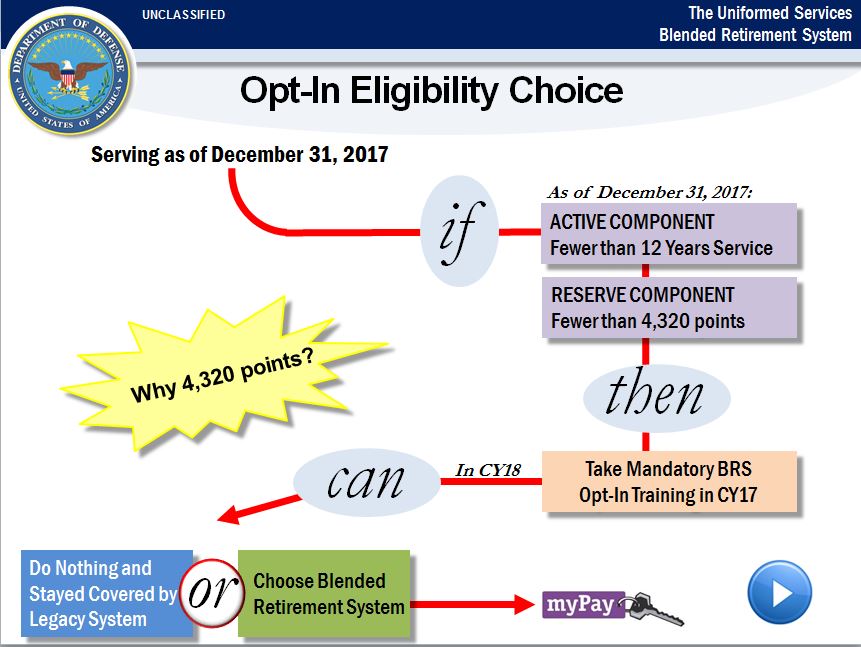

- Everyone currently serving in the Uniformed Services as of December 31, 2017 will be grandfathered under their current retirement system.

- NO ONE will be automatically moved to the Blended Retirement System.

- Those who joined before 2006 and members of the Reserve Component with more than 4,320 retirement points will remain under the legacy retirement system.

- But some Service members may have a choice to make.

- Active Component Service members who joined after 2006, but before Jan. 1, 2018, and Reserve Component Service members with less than 4,320 retirement points as of January 1, 2018, will have the choice of whether to stay with the legacy retirement system or opt in to the new Blended Retirement System.

- New accessions after January 1, 2018, will automatically be enrolled in the new Blended Retirement System.

Let’s take a more detailed look at the new Blended Retirement System.

- TSP: The Blended Retirement System includes a TSP component.

- All Service members joining after January 2018, will be automatically enrolled into the TSP at 3% of their base pay, with automatic 1% DoD contributions starting after 60 days, and DoD matching up to 4% at the start of the third year of service.

- Both the DoD automatic 1% and the matching contributions continue through the end of the pay period during which the Service member attains 26 years of service.

- NOTE: Current Service members who opt-in to the new Blended Retirement System between January 1, 2018, and December 31, 2018 (we’ll talk about opting-in in a moment) will receive DoD automatic 1% contribution and up to 4% additional DoD matching beginning the first pay period of election. There will be no “catch-up” contributions for previous months of service.

- MONTHLY RETIRED PAY: For those who retire after at least 20 years of active service, the retirement remains predominantly a defined benefit in which the Service member will get monthly retired pay.

- Instead of being calculated at 2.5 percent times the average of the Service member’s highest 3 years of basic pay, the Service member’s monthly retired pay will be calculated with a 2.0 percent multiplier.

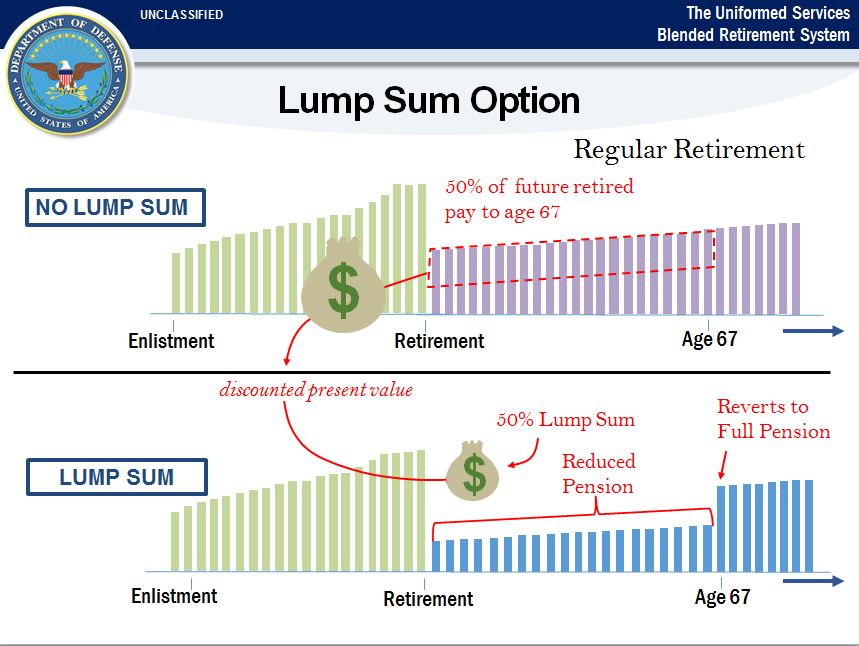

- LUMP SUM: The lump-sum option gives Service members choices at retirement.

- The lump-sum option allows Service members to choose to elect 25% or 50% lump-sum payment at retirement in exchange for reduced monthly retired pay until the Service member reaches full Social Security retirement age, which for most is 67 years old.

- The DoD continues to work on guidance related to this provision of the Blended Retirement System.

- CONTINUATION PAY: The National Defense Authorization Act of Fiscal Year 2016 also included a continuation pay provision as a way to encourage Service members to continue serving in the Uniformed Services.

- Continuation Pay is a direct cash payout, like a bonus.

- It is targeted at the mid-career mark, between 8 – 12 years of service (change was made in 2017 NDAA).

- The DoD continues to work on guidance related to this provision.

The lump-sum option is a new option for service members under the Blended Retirement System, providing choices at retirement. The lump-sum option allows service members to choose to receive 50-percent or 25-percent of the discounted net present value of their future retirement payments at retirement in exchange for reduced monthly retired pay until the service member reaches full retirement age. The monthly retired pay reverts to the full pension amount when the service member reaches Social Security retirement age, which for most will be 67 years old. No such lump-sum option exists under the legacy military retirement system.

NOTE: The law establishing the Blended Retirement System directs the Secretary of Defense to consider personal discount rates in establishing the discount rate used to determine the lump sum payment amount. The Department has made no decisions on personal discount rates. The DoD continues to work on guidance related to this provision of the Blended Retirement System.

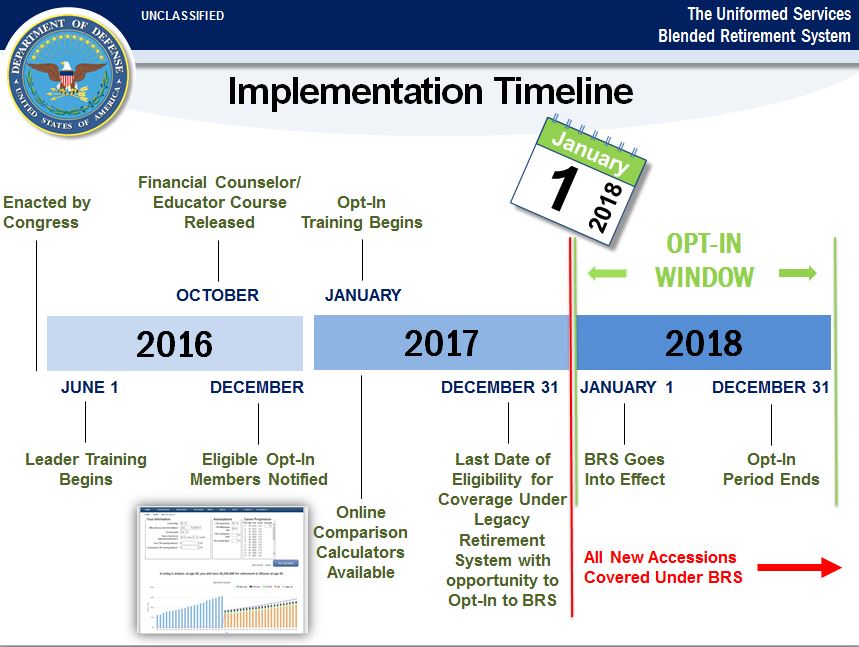

The timeline above outlines major milestones along the way towards implementation of the Blended Retirement System.

A few key milestones to highlight:

- November 2016, Eligible Opt-In Members Notified: Services will begin notifying eligible Opt-In Service members starting in November 2016.

- January 2017, Opt-in Training begins: Members with fewer than 12 years of service as of December 31, 2017 (or fewer than 4,320 retirement points in the case of Reserve Component members) are grandfathered under the current retirement system, but will be eligible to opt-in to BRS. This is a required course and will aid eligible Service members, both active and reserve, in understanding and comparing the legacy and new retirement systems.

- January 1, 2018 – December 31, 2018, OPT-IN WINDOW: The opt-in or election period for BRS will begin January 1, 2018 and conclude on December 31, 2018.

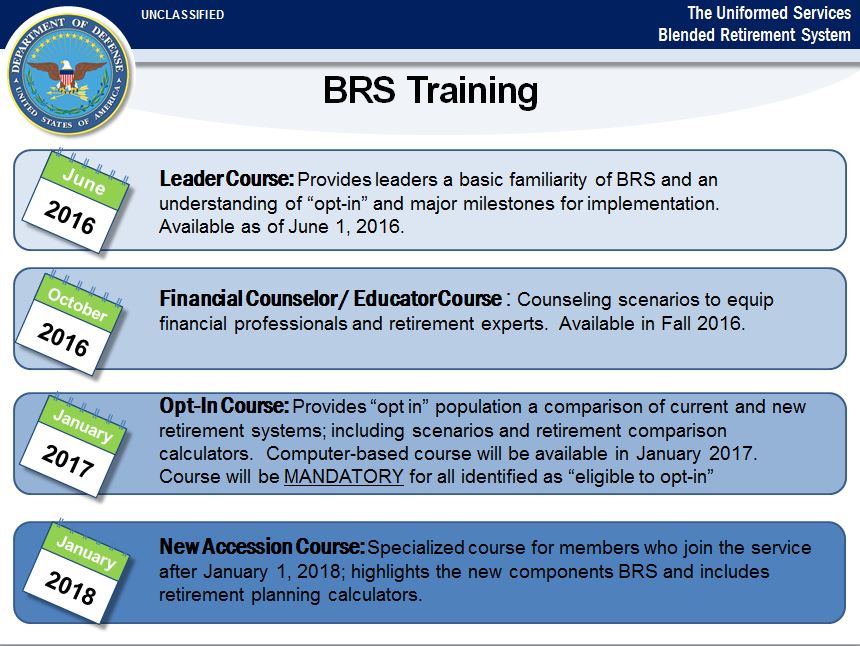

- The DoD has initiated an 18 month long multi-stage financial education training curriculum to fully prepare Active and Reserve component members and their families. These courses will be available on Joint Knowledge Online (JKO) .

- The Leader Course is designed to provide military and civilian leaders with an understanding of the key components of BRS and the DoD plan to educate the force, including retirement plan comparisons, key milestones, and an overview of the opt-in option for Service members. Although geared towards leaders, BRS-LC is available to all Service members on JKO and MilitaryOneSource.mil. Anyone looking for additional information is encouraged to take the course.

- The second course is the Personal Financial Counselors/Educators Course. This course will focus on various counseling scenarios to equip financial, retirement and similar advisers who assist commanders,

- The Opt-in Course will be a required course for all eligible Service members. It will aid eligible Service members, both active and reserve, in understanding and comparing the legacy and new retirement systems. Service members will use the knowledge gained from this course combined with their personal assessments of career goals and financial situations to decide which retirement is best for them.

- Finally, the New Accession Course is geared to Service Members who begin their service on or after January 1, 2018, will be covered by BRS. All new Service members will be required to complete BRS-NAC within their first year of service.

So thinking about how each individual circumstances are unique, we can walk through the eligibility chart for just about anyone and determine how they are impacted by the opt-in process.

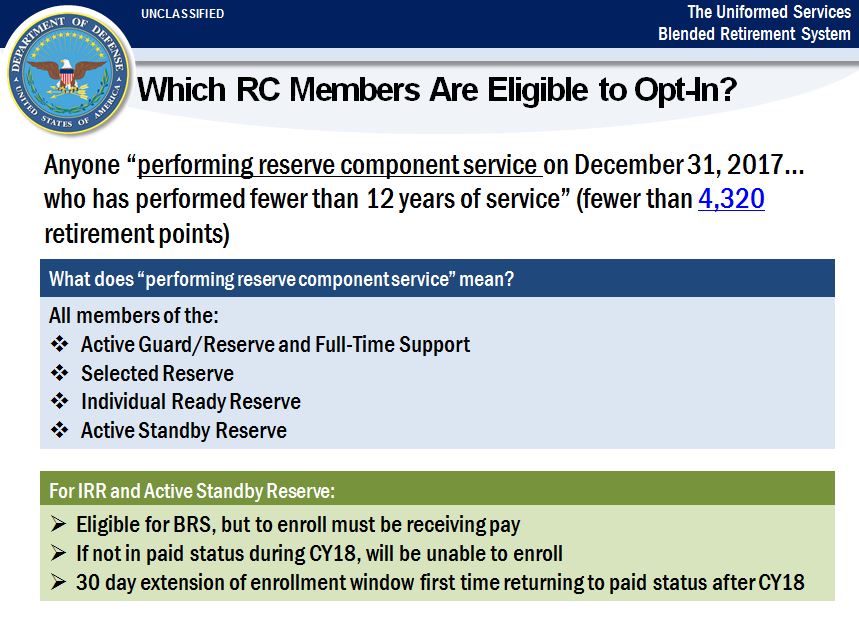

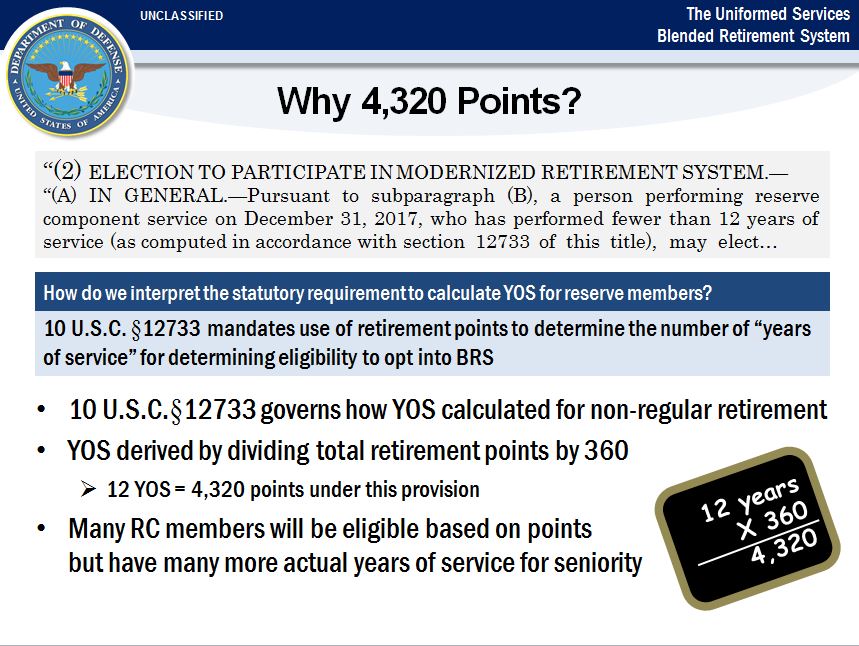

Special note about the Reserve Component: The Reserve component is a bit unique in how eligibility is determined. This different eligibility criteria is based on language in the FY16 NDAA that mandated use of 10 U.S.C. §12733 to compute eligibility for RC members; it governs how years of service is calculated for a non-regular retirement.

For retirement, reserve service is converted to active service by dividing retirement points by 360. Remember, the military considers a month as 30 days for pay purposes, so each day is worth 1/30th of a month; 12 months would then equal 360 days. Thus, a Reserve with 4,320 retirement points equates to 12 years of active service.

Members of the Individual Ready Reserve (IRR) are also eligible to participate in the Blended Retirement System, but in order to elect to enroll into the Blended Retirement System they must be receiving pay (because of the Thrift Savings Plan component). Therefore, members of the IRR who are eligible to enroll in the Blended Retirement System (because they are in the IRR as of December 31, 2017), but who do not drill in a paid status at all during calendar year 2018, will be allowed a one-time extension of the enrollment window beyond 2018.

Not eligible for BRS:

- Retired Reserve

- Inactive National Guard

- Inactive Standby List

Eligibility to opt-in is much broader for the RC than AC. Unlike the AC, where eligibility to opt-in is based on having served for less than 12 years, any RC member with fewer than 4,320 retirement points as of December 31, 2017, will be eligible to opt-in during CY 2018, regardless of how many years they have actually been in the service.

This different eligibility criteria is based on language in the FY16 NDAA that mandated use of 10 U.S.C. §12733 to compute eligibility for RC members; 10 U.S.C. §12733 governs how years of service is calculated for a non-regular retirement.

Under 10 U.S.C. §12733, “years of service” is derived by dividing 360 into the total points earned during an RC member’s career, resulting in credit for a certain number of equivalent “years of service” – 12 years of service therefore equals 4,320 points.

This differing criterion makes the pool of members eligible to opt-in to BRS much larger in the RC; but it is important to note these members will remain covered under the current retirement system unless they choose to opt-in.

Members of the IRR are also eligible to participate in BRS, but in order to elect to enroll in BRS they must be receiving pay (because of TSP). Therefore, members of the IRR who are eligible to enroll in BRS (because they are in the IRR as of December 31, 2017), but who do not drill in a paid status at all during calendar year 2018, will be allowed a one-time extension of the enrollment window beyond 2018.

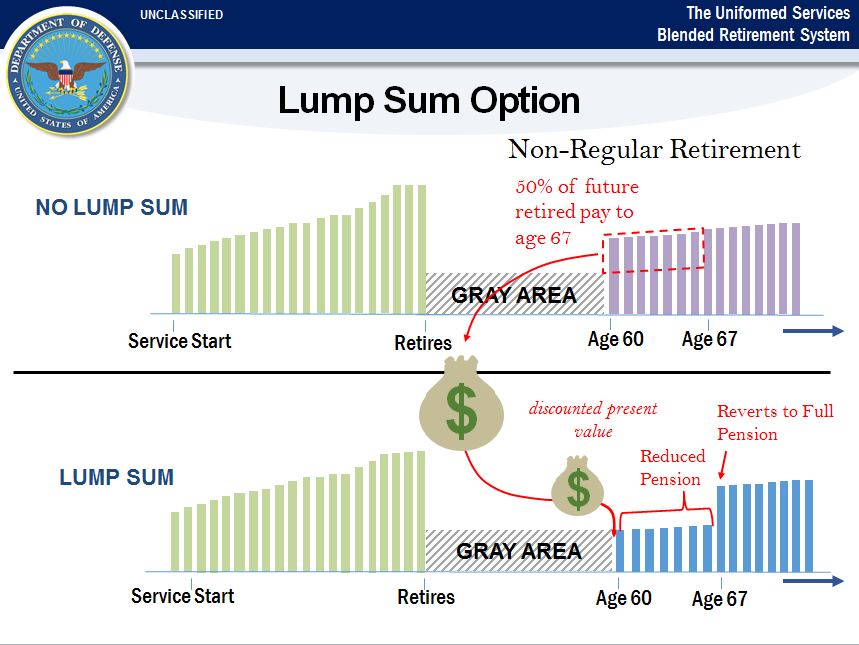

Just like with Active Duty members, the lump-sum option is a new option for RC members under the Blended Retirement System, providing choices at retirement. The lump-sum option allows RC members to choose to receive 50-percent or 25-percent of the discounted net present value of their future retirement payments when eligible to receive retired pay at approximately age 60 in exchange for reduced monthly retired pay until the service member reaches full retirement age. The monthly retired pay reverts to the full pension amount when the service member reaches Social Security retirement age, which for most will be 67 years old. No such lump-sum option exists under the legacy military retirement system.

NOTE: The law establishing the Blended Retirement System directs the Secretary of Defense to consider personal discount rates in establishing the discount rate used to determine the lump sum payment amount. The Department has made no decisions on personal discount rates. The DoD continues to work on guidance related to this provision of the Blended Retirement System.

- The Blended Retirement System does not change when a member is eligible to retire.

- Members covered by the Blended Retirement System may still elect to participate in the Survivor Benefit Plan.

- The Blended Retirement System does not change the law on division of retired pay under the Uniformed Services Former Spouses Protection Act

- Reservists covered by the Blended Retirement System are still eligible for reduced age retirement if they perform qualifying service.

There is no single right answer as to which retirement system is better. Both the legacy retirement system, often called the “High-3” system and Blended Retirement System may have advantages and disadvantages based on a Service member’s particular circumstances.

Those members who have the option of choosing their retirement system should base their decision entirely upon their own circumstances, after completing the training and taking advantage of all of the information and resources available.

For some, staying under the legacy retirement system will make sense. For others, the Blended Retirement System will be a preferable option. Once the DoD releases the official BRS Calculator in early 2017, the calculations performed there will be tremendously helpful in illustrating the preferred plan for you.

For more information, check out these other resources:

- DoD Blended Retirement System Resource Webpage: http://militarypay.defense.gov/BlendedRetirement

- Blended Retirement System Leader Course: (CAC required): https://jkodirect.jten.mil

- Blended Retirement System Leader Course: (Non-CAC): http://jko.jten.mil/courses/brs/leader_training/Launch_Course.html

- Military OneSource Website: www.militaryonesource.mil

- A MyPay account is required to make BRS and TSP elections: https://mypay.dfas.mil

- Information on TSP can be found at www.tsp.gov

- Learn more about saving money, reducing debt, and building wealth: www.militarysaves.org

Other Bloggers’ Great Content on the BRS:

- The Military Guide: http://the-military-guide.com/new-military-blended-retirement-system/ and http://the-military-guide.com/beware-huge-flaws-military-blended-retirement-system/

- Military Money Manual: http://militarymoneymanual.com/brs/

- Military Wallet: http://themilitarywallet.com/blended-military-retirement-expert-opinions/

- Kate Horrell: http://www.katehorrell.com/understanding-proposed-retirement-changes/